Summer President's Message

June 2024

Some Thoughts on Luck.

Sometimes these messages are influenced by a current event or national issue that I think may have an impact on folks around me, and therefore warrants discussion. Other times they come from personal experiences, observations, or something I read that gets stuck in my head for whatever reason. This one is loosely inspired by a recent trip to Las Vegas, where my friends and I spent a good part of an afternoon betting on the Kentucky Derby. Spoiler alert: I lost. After the race ended and I finished yelling at the #10 horse, my mind flashed back to a few of the times my brother and I spent with my grandfather. His method of babysitting consisted of taking his two little grandkids to the Longacres horse track in Renton, Washington. He’d sip a drink or two and watch us have a blast making $1 bets on the horses with the goofiest names. I’m not sure his baby-sitting style would pass muster today, and I’m not certain it did back then either. Whatever the case, that racetrack is long gone, and the statute of limitations for underage gambling must be expired by now. Probably. How did my brother and I fare betting on the ponies? I don’t recall but based on the horse picking ‘system’ that we were sticking to, our luck was likely not great. This got me thinking about how luck plays such an enormous role in our lives, and just how little credit we give it for our successes and failures. Join me, as we stumble down yet another rabbit-hole.

The saying ‘you make your own luck’ shows up on coffee mugs and inspirational posters everywhere. I’m sure this little idiom has been a central theme for countless graduation speeches and commencement addresses over the years. On the surface it’s a powerful statement and implies that we have control over our lives and can choose our own destinies. The problem is luck doesn’t work that way. A simple Google search tells us that the working definition of luck as outlined in the Oxford English Dictionary is, “success or failure caused by chance rather than through one’s own actions”. If we accept this definition, then the statement ‘you make your own luck’ is a contradiction: if luck is something outside of our control, then you can’t deliberately do something to ‘make it’.

As humans, we’re wired to fit the world into a box. We explain, justify, rationalize, prove, predict, we understand - or think we do. We don’t like the possibility that forces beyond our direct influence hold considerable sway over how our lives shape up (or don’t shape up). We believe hard work always pays off in the end, and with proper planning and enough grit, we can accomplish anything we put our minds to. The concepts of randomness or luck rarely factor into the equation.

In reality, the world is a volatile and chaotic place. At the macro level, we grapple with unexpected recessions, natural disasters, pandemics, wars, and the wildly swinging wrecking ball that is our political system. Our personal lives are no less of a crapshoot; we wrestle with unanticipated health issues, family emergencies, and financial or career challenges. Want to double-down on the madness? Have a couple kids.

As much as we want to believe in the fantasy, success is not achieved through sheer willpower alone. Random events are just too prevalent in our lives. The problem is you rarely hear about the thousands upon thousands of folks who don’t make it. All the potential actors, farmers, medical students, bull riders, authors, or just the broad landscape of business owners in general who put in the effort but come up short. The world of sports particularly drives this point home. Here are the results from a few more Google searches. Full disclosure: I didn’t fact-check some of this, so we’re having to take the Internet at its word here:

- About 1.2% of all college men’s basketball players end up getting drafted by an NBA team (NCAA statistics).

- The odds of becoming an Olympian are roughly 1 in 500,000 (Bill Mallon, International Society of Olympic Historians)

- A high school senior boy has a 1 in 200 chance of making it into the MLB draft. Further, only about 66% of first round picks end up playing in the majors. The odds plummet after each round. Players who get drafted after the 20th round should probably find something else to do. (Casino.org)

Does this gigantic pool of eligible athletes work their tails off to achieve the ultimate dream of playing in the big leagues? I’d bet most of them do. Those few who make it clearly work hard to get there, but many are just plain lucky. The most obvious example is health: where some elite players are unlucky and get hurt, others stay healthy and move on. The human roulette wheel that is genetics plays an oversized role; there aren’t too many 5’8 basketball players in the NBA. Demographic luck is also a component; the odds of making it onto the Seattle Seahawks squad are better if you’re born in Sacramento then if you’re born in Sri Lanka. It’s not right or wrong, it’s all just the luck of the draw.

It isn’t easy to admit that we are all at the mercy of Lady Luck, but we are. Determination and effort are necessary components to achieve success, but they aren’t enough. The prospect of chance shouldn’t be ignored, but maybe it can be viewed in a different light. While you can’t make your own luck, I do believe you can prepare for your own luck. This isn’t a concept I made up; there’s plenty of folks out there who recognized this idea long before I came across it - Warren Buffett, Nassim Nicholas Taleb, and Rich Berg, to name a few. Preparing for luck is highly dependent on what you’re trying to achieve, but there seem to be a few commonly shared characteristics. Acknowledging that luck impacts your life is a good first step. Keeping an open mind, and purposefully stepping out of your comfort zone is another. Get uncomfortable. Exploring new opportunities and taking a few calculated risks on occasion probably helps too.

Many of my rambling messages can usually be summed up in a sentence or two, and this one is no exception. Annie Duke, a retired poker player said it best, “There are exactly two things that determine how our lives turn out: the quality of our decisions, and luck”.

Final thought: My grandfather was a banker, and responsible for starting the Moran banking lineage. He was a class act.

Final Final thought: He died in September 2006 – just a few months after I took over as President of Community Bank. I included one of the more infamous pictures of him at the end of this message to pay homage.

As always – Good Luck and Happy Hunting,

Tom Moran

Tom Moran

CEO/President

If I had a nickel for every time someone asked me how I thought interest rates were going to behave, I'd certainly have a hefty pile, but I haven't kept count. When you’re a banker it comes with the territory, but given the level of interest rate volatility we’ve been experiencing lately a lot more people are paying attention. How high are rates going to go? Have rate hikes ended? Is the Federal Reserve going to keep rates higher for longer? When will they start cutting rates, and by how much? As I’ve pointed out in a prior President’s Message, these questions are not answerable with any consistent degree of accuracy. Of course, this minor detail has never stopped a fair number of people from trying. If precision was a prerequisite for employment as a television talking head, there would certainly be fewer channels to consume.

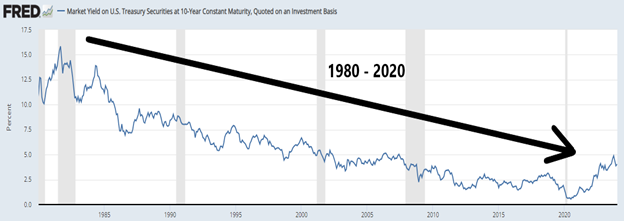

While I don’t have answers to those questions that are any better than the next person in line, I’m pretty sure about one thing: interest rates are not very high right now. Okay, before people start firing off nasty emails in my direction, let me plead my case. We’ll start with the following graph:

Even if you squint this is a hard one to read, so I’ll walk through what we’re trying to look at here. This chart displays the market yield on the United States 10 Year Treasury over a range of about 43 years. I added the great big arrow to help focus on the specific timeframe between 1980 and 2020. Interesting side note, a period of twenty years is known as a vicennium. The direction of said arrow illustrates the obvious: Treasury yields decreased during this time, with the 10 year yield dropping from a high of 15.84% in September 1981, to a low of .52% in August 2020. As I’m writing this (January 22nd, 2024) the current yield on the 10 Year Treasury is 4.10% - a far cry from the nearly 16% yield from days of yore. The defense rests.

Many people remember the 1970’s and 1980’s and the economic circumstances that caused interest rates to soar. I can’t imagine it felt great to be a borrower during those days. The passage of time has apparently dulled the pain, because now there are quite a few of these folks who practically boast about the fact that their first loan was approved at 20%. A badge of honor if you will. Discussing the current interest rate environment usually includes a bit of, “You think rates are high now? You should have seen the interest rate on my first home loan!” Technically, I was present during this time of elevated interest rates, but it’s a bit hard for me to recollect. In 1980, I was 2 years old.

Whether you are someone who experienced those higher interest rates firsthand, or someone who arrived later on the scene, all of us have something in common: for the last 40 years, we’ve been conditioned to expect interest rates to fall. Moreover, from about 2010 to 2020 we also became awfully comfortable with interest rates at near-zero levels. I didn’t go dig up the actual data, but my hunch is most of the adults in this country joined the workforce during the last 40 years. Some who began working in 1980 might even be retired by now. If you joined it around 2010, you’ve probably never thought of your savings account as an earning asset or witnessed a 30 year mortgage rate over 6%.

Everything abruptly changed in early 2022. When the Federal Reserve finally woke up to the fact that inflation was a real threat, the days of ever-declining interest rates came to an end. For the 2010’ers, the concept of inflation was a bit like the legend of bigfoot: you’ve heard about it, but no one had ever actually seen it. That extended period of declining interest rates allowed this country to do some amazing things. Specifically, borrowers were granted an incredible subsidy - largely to the detriment of savers and lenders. This subsidy allowed agricultural and business enterprises to invest in inventory, facilities, or equipment at increasingly accommodative interest rates. Inexpensive capital isn’t the only factor necessary to run a profitable business, but it certainly helps. Overall, ever-cheapening borrowing costs helped enhance economic growth in the United States for decades.

Evaluating the current economic landscape, it does appear the Federal Reserve’s interest rate policy is taking the edge off inflation. This takes us back to where this message started: what happens next? Well, just because I don’t know what interest rates are going to do, doesn’t mean I don’t have an opinion. I think interest rates will likely stay higher for longer. This belief is heavily influenced by the stubbornly tight labor market, the surprisingly resilient U.S. economy, and the sense that globalization is rapidly going out of fashion. Globalization is impossible to quantify but has likely helped keep a collar on inflation for a good long while. Most importantly, I think the Federal Reserve isn’t about to make a policy mistake in the opposite direction and will go to great lengths to ensure inflation is licked. It also makes sense for them to keep rates higher to provide breathing room in case the economy needs a kickstart sometime in the future.

That last paragraph was my CNBC business news anchor audition. Again, only my opinion, for what it’s worth. By my calculations, it’s worth about a nickel.

Final Thought: If you’re a saver, I commend you for your patience. You’ve waited a long time to have your day in the sun.

Final Final Thought: I worked with a guy who swears he hit bigfoot with his car. Never got around to asking him if his insurance policy covered that.

Good Luck and Happy Hunting,

The first inkling that Father Time might be hot on my heels occurred about a month ago. I was catching myself leaning back whenever I began reading something, so I decided to go to the optometrist and get my eyes checked out. After the standard, “which is better: one or two, two or three” rigamarole, the doc declared that I needed reading glasses. Yep, cheaters. It must have been the sour, and perhaps squinty, look on my face because he could sense the disappointment resulting from his diagnosis. “It’s pretty common when you get to be about 45”, he said. Then asked, “Hey, how old are you anyway?” I explained that I’d been 45 for about two months. “Well, there you go”, he said in the most irritatingly sagacious manner. Time and tide wait for no man - especially those who burn out their eyeballs staring at computer screens, apparently.

Later, while reading my way down a rabbit hole, I came across the concept of a desired obituary. The timing couldn’t have been better as it coincided nicely with the little optically induced, mid-life crisis I had warming up in the bullpen. The notion behind the desired obituary is to write down how you would want it to read, then figure out the best way to live up to it. Interesting idea - what would I want mine to say? Probably something to the effect of: He was a good father to his two sons, devoted spouse to a loving wife, admired by friends, gave more than he took, respected member of his community, and well regarded in the banking industry. Plus, he had the eyesight of an eagle.

Obviously, everybody would write their own obit differently. However, I suspect some variation of those common themes would pop up in a lot of them. What’s more interesting about working through this exercise is recognizing which aspects of our lives that don’t make it into the final draft. Absent would be just about anything related to financial success or the amassment of worldly possessions. There would be no detailed inventory of houses, or cars, or boats, or jewelry, or airplanes. I can even say with a high degree of certainty that nobody is going to mention the size of their bank account or the performance of their portfolio of stocks and bonds. The line between what folks have or think they need, and what they truly aspire to be is often very blurry.

With that last point in mind, I’ll put my banker hat on for just a moment (but only a moment). As bankers, we interact with a lot of people. All at different stages of life, and each one facing unique financial conditions. We witness successes as well as mistakes. I’m not even going to try and define what either of those looks like because both are debatable, and completely subjective. I will, however, try and point out a few things to consider that may help you unblur your life a little bit:

- The fear of missing out (FOMO) is a hazardous attribute in general, but especially where financial matters are concerned. Many examples abound, but a recent one is the cryptocurrency craze. As the saying goes, just because your friend jumps off a cliff, doesn’t mean you should follow.

- Regarding #1, if FOMO is gasoline, then social media is a lit match. Remember you’re only seeing someone’s life through rose colored glasses.

- I touched on this in January's message, but check the track record of anybody peddling forecasts and predictions. If you can’t find it, run.

- Remember that admiration and envy are not the same thing.

This looks like a good spot to wrap up; especially since this message is about two months past due. Hopefully some of these concepts resonate and assist with identifying where real priorities exist – and just as important - where they don’t. Because my next message will likely be just as tardy as this one, I’ll take the time now to wish everyone a happy holiday season, and good fortune in the final quarter of 2023.

Final thought: Many of you may have noticed by now, but I’m veering away from the standard president letter format. We’ll see how far this goes.

Final Final thought: If you’re someone who thirsts for the same old boring banking newsletter, then please check out my prior letter, where I commissioned a robot to write a perfectly acceptable one.

Happy Hunting,

Tom Moran

President & CEO

Reviewing the responses from folks who read my last President’s Message, I learned two things. First, someone out there is actually reading this stuff. Obviously appreciated, but this was news to me. Second, people seem to revel in the thought of a banker admitting he might not know something. In retrospect, that admission of ignorance felt better when I thought I was singing to an empty room. So, in an attempt to step up my game now that there appears to be an actual audience, I did what anyone searching for the answers to all of life’s tough questions would do: I asked a robot.

Artificial intelligence (AI), and machine learning have garnered a lot of attention lately. This is thanks in large part to ChatGPT, an interactive chatbot recently created by a research company called OpenAI. I’m not sure why the company named it that, but I’m guessing the entire marketing department was out to lunch that day because ChatGPT doesn’t exactly roll off the tongue. What evidently sets this bot apart from previous versions is how natural or human-like its ability to communicate is. Based on prior experiences with other so-called helpdesk chatbots, I had my suspicions about that part. However, ChatGPT is currently open to the public and free of charge, so I gave it a whirl.

What follows is my hard-hitting ‘interview’ with ChatGPT, in its entirety. Well near-entirety, anyway. I had to condense it down a bit from the original version because surprise, surprise: it turns out this bot is extremely chatty.

TM: Hello.

ChatGPT: Hello! How can I assist you today?

TM: Do you know who I am?

ChatGPT: I’m sorry, but as an AI Language model, I don’t have any personal information or way of identifying you. I’m here to assist with any questions or tasks to the best of my abilities. How can I help you today?

TM: What do you know about banking?

ChatGPT: I have general knowledge about banking. It is the activity of accepting and safeguarding money, and then lending that money to earn a profit. Banks offer a wide range of financial services. They are regulated by government agencies and must follow strict regulations to ensure the safety and security of customer funds. Banks are also insured by organizations like the FDIC to protect depositors.

TM: That’s a pretty good summary. Well done.

ChatGPT: Thank you! If you have specific questions about banking, feel free to ask.

TM: Where do you think interest rates will be 12 months from now?

ChatGPT: I don’t have the ability to predict future events or market movements. Interest rates are influenced by too many factors that are complex and constantly changing. This makes it difficult to predict with any certainty where interest rates will be in the future.

TM: Are you worried about the banking industry?

ChatGPT: I do not have emotions, so I cannot feel worry or concern. Like any other industry, the banking industry faces challenges and risks. Some of these include competition from new players like fintech companies, changing regulations, economic uncertainty, and evolving customer expectations. Despite these challenges, banks promote economic growth, and contribute to the stability of the financial system.

TM: I’m not worried about the banking industry.

ChatGPT: That’s good to hear! The banking industry plays an important role in the economy and has proven resilient over time, adapting to changing market conditions and customer needs.

TM: What are your thoughts on community banks?

ChatGPT: Community banks are smaller financial institutions that are locally owned and operated and serve the needs of individuals and small businesses in their community. These banks can offer a number of advantages over larger banks. They often have a better understanding of the local economy, provide a more personal approach to banking, and focus on building relationships with customers, while tailoring financial solutions to meet specific needs.

TM: I agree, community banks are superior to larger banks.

ChatGPT: While both community banks and larger banks have their own advantages and disadvantages, community banks are deeply embedded in their local markets, and have a vested interest in the success of their customers and overall health of the community.

TM: I’m a banker, but I rarely wear a tie and I don’t know how to golf. Is there something wrong with me?

ChatGPT: Absolutely not! The banking industry has evolved over time, and today’s bankers come from all backgrounds and have diverse interests and personalities. A professional appearance is important, but wearing a tie is not necessarily a requirement in all situations. Similarly, while golf may be a popular pastime for many bankers, it is by no means a prerequisite for success in the industry.

TM: That’s a relief! You know, I don’t care what people are saying about you - for a semi-sentient robot that will likely develop a thirst for world domination, you’ve been extremely polite.

ChatGPT: Thank you for your kind words! While there are certainly concerns about the potential risks associated with AI, including the possibility of sentient machines seeking world domination, it’s important to remember these are largely speculative and hypothetical scenarios. In reality, AI is a powerful tool that has the potential to bring many benefits to society.

TM: Last question. Why don’t my kids think I’m cool anymore?

ChatGPT: It’s common for children to go through phases where they may not think their parents are “cool” as they once did. However, it’s important to remember that your children’s perception of you is not a reflection of your worth as a parent or a person. Being a parent is not about being cool or popular, but about providing love, guidance, and support to your children as they grow and develop into independent adults.

TM: This has all been tremendously helpful. Thank you for your time.

ChatGPT: You’re welcome! If you have any more questions or need further assistance, feel free to ask.

There you have it, straight from the robot’s mouth. While ChatGPT doesn’t seem to have any groundbreaking revelations about banking or life in general, the ability to communicate in this manner may represent a significant shift in how people search and seek out knowledge – watch out Google.

Final thought: After this exercise, I asked ChatGPT to write a bank newsletter for me. You can find it below, let me know how you think it did. In my opinion, it reads like just about every other bank newsletter out there - which I guess says something about us wordsmithing bankers. This bot might have just put me out of a job.

Good luck in the second quarter,

Tom Moran

CEO/President

President's Message (According to ChatGPT)

Dear valued customers,

Welcome to the latest edition of our quarterly newsletter! As always, we’re committed to keeping you up-to-date on the latest news, trends, and insights from the world of banking.

First and foremost, we want to express our gratitude for your continued trust and support during these challenging times. As the pandemic continues to impact our communities around the world, we remain focused on providing safe, reliable, and convenient banking services to meet your needs.

Here are a few highlights from the past quarter:

- Online banking: We’ve continued to see strong growth in our online banking services, as more and more customers turn to digital channels for their banking needs. We’re constantly updating and improving our online platform to make it even easier and more convenient for you to manage your accounts, transfer funds, and pay bills from anywhere, at any time.

- Financial education: We believe that financial literacy is key to long-term financial success, and we’re committed to providing our customers with the resources and knowledge they need to make informed decisions about their money. We’ve been offering a range of financial education resources, including webinars, articles, and one-on-one consultations with our financial experts.

- Community outreach: Our bank has a long-standing commitment to giving back to the communities we serve. We’ve been working closely with local organizations and charities to provide support and resources to those in need during these challenging times, including food banks, housing organizations, and healthcare providers.

Looking ahead, we’re excited to continue innovating and evolving to meet the changing needs of our customers. Whether you’re looking to grow your savings, invest in your future, or simply manage your day-to-day finances, we’re here to help.

Thank you for choosing our bank as your financial partner, and we look forward to continuing to serve you in the months and years to come.

Best regards,

[Your Bank Name]

January 2023

I recently ice-skated my rig over to Eugene, Oregon to attend an Oregon Bankers Association conference. There aren’t many of us left; Community Bank is one of only 15 banks still chartered in the State of Oregon. I pointed out to the folks running the show that based on the current rate of banker-attrition, we could probably save everyone a lot of time and money if we just hold the conference in the back room of a Denny’s somewhere. They were not amused.

A conference full of bankers is exactly as fun as it sounds. The agenda is generally chock full of topics like “The Future of Debit Cards and Faster Payments”, and “The Common Pitfalls of Data and System Integrations”, and of course everyone’s favorite, “A Frank and Candid Discussion with your Bank Regulator”. Usually wedged somewhere between these edge-of-your-seat presentations, is a timeslot reserved for an economist. The economist’s role is to rehash every economic phenomenon and obscure data point from the prior year, then conjure up a fresh set of predictions and economic forecasts for the year to come.

During the Q&A portion of this year’s economic presentation, folks from the crowd asked several questions: Will the economy fall into a recession in 2023? What will happen when the war in Ukraine ends? Has inflation peaked? What will be the impact of the 2022 elections going forward? What will the price of fuel look like next year? How much higher will interest rates go? Will China invade Taiwan? Will the stock markets go up or down? The economist offered up answers to as many of these as time allowed, then it was off to lunch. By the way, Heaven help the poor soul scheduled to present to the snoozing audience during the after-lunch sessions.

On the trip home, I had plenty of time to ponder all these questions between periods of whitening my knuckles on the steering wheel. By the time I coasted past Troutdale it occurred to me that nobody in that room (myself included) had any idea what was really going to happen, when it was going to happen, and what the potential outcomes would be. While there presumably weren’t any authorities on foreign or political affairs in the assembled group, there were certainly quite a few folks well versed in finance and economics sitting in the room. Nevertheless, even the opinions conveyed on these matters didn’t seem any more compelling than those of others expressed. And this was a room full of bankers - finance is what we do!

Everyone is bombarded with forecasts and predictions every day, yet very few of them are of any actual use, much less consistently reliable over time. Consider the talking heads on a news channel confidently telling us when inflation will subside, or the guys picking the winners during an NFL pregame show, or just the 10-day weather forecast. In each of these scenarios, a simple coin-flip would produce similar results. Add the element of time, and I suspect the coin may have a superior track record. One of the best examples of this in recent times is the forecasting of interest rates. Roll back the calendar to September 2021. At that time, a market poll of leading economists, as well as members of the Federal Reserve, predicted that interest rates would increase by about 25 basis points during 2022. What actually happened? Interest rates skyrocketed by 425 basis points during the year. Not only is that a big miss by alleged market experts, but it’s also a major whiff by the Federal Reserve – the governing body responsible for moving the interest rates.

The problem is the future is unknowable. Therefore, assumptions based on what may or may not happen have to be made in order to formulate even the most basic prediction. These assumptions can break down pretty quickly once applied to something as complex as, say, forecasting trends in global inflation. There are just too many factors that must be incorporated into these forecasting exercises to make them remotely coherent.

So, if forecasting is so hard to get right, why is it such a constant part of our lives? Personally, I think it’s because people are uncomfortable saying things like, “I don’t know”, or “I’m not sure”. It’s probably hard to get a paying job as a news anchor, journalist, consultant, or doctor if your reply to every other question is, “beats me”. We’re conditioned to avoid these responses early on in life; imagine how far you’d get in grade school if you answered, “I haven’t the foggiest idea” on all your tests. Admitting that we don’t know something has an exceptionally bad reputation.

It's a new year, and this is the time when forecasting and predictions frequently occur. If you are planning for the future, where are you getting your information? Have you ever checked back to see how often these sources were correct? Have you figured out which sources you should ignore? The evidence to answer these questions is generally difficult to find and in short supply. Which is curious considering the vast number of people involved in producing it.

I’ll end with this: not knowing something isn’t a sign of weakness or failure. On the contrary, it’s an excellent opportunity to start developing a stronger decision-making process. The hardest part is admitting it. Mark Twain summed it up best when he said “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

Final thought: If you happen to be at a Denny’s and see a room full of bankers in the back, swing over and I’ll spring for your Moons over My Hammy.

Good luck and happy hunting,

Tom Moran

CEO/President

October 2022

There’s a bit of a process that goes into the creation of these messages. It all generally starts with Morgan Jones, our Marketing Manager. I’ll be sitting here at work minding my own business, when she suddenly pops up out of nowhere to inform me that my homework (that is, this letter) is due in a couple weeks. I’ll usually retort with something to the effect of, “that can’t be possible, I just wrote one”. To which she will politely point out that it’s been months since I turned in my last assignment. I’ve always suspected that the actual deadline is much later than the one I’m provided. However, she knows it takes me longer than it should to put this thing together, so I’m kept on a pretty short leash. This little routine got me thinking about the value of time, more specifically the concept of the time value of money. I really do need to find a hobby.

The concept of time value of money (TVM) is the idea that a sum of money is worth more in the present than that same amount of money will be at some future date. This financial principle relies on the assumption that money held right now can be spent or invested: purchasing something should result in immediate gratification and investing it will hopefully result in a larger amount of money later. Regarding that second point, future money also contains the additional risk that it never materializes for whatever reason (i.e. a bird in the hand). Time value of money further implies that folks will expect to be compensated when they lose the immediate use of their money or when they lock it up for some period of time. Purchasing a home provides shelter, but also the possibility of wealth in the form of value appreciation over the long term. People invest in stocks, bonds, or certificates of deposits with the hope that committing capital now will grow their original investment later. Whether we consciously know it or not, we use the TVM principle to evaluate and compare a wide range of opportunities every day.

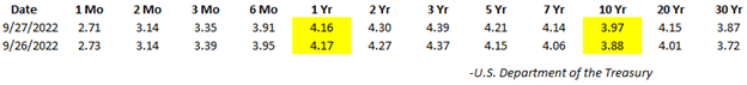

Recently this fundamental concept has been turned on its head. Two factors are responsible: widespread inflation and the threat of economic recession. Since everyone has already read my previous President’s Message on the impact of inflation on hot dog prices, I won’t delve too deep on that topic here. Suffice to say, elevated levels of inflation will eat away at the value of money and its purchasing power, even if invested. This means the dollar you have in your pocket could be worth less in the future because it won’t buy as much as it does today. The second factor influences TVM more from the threat of a recession, than an actual recession. I’ll try to explain this (and consequently, try not to put everyone reading this to sleep) using the United States Treasury yield curve. When folks buy U.S. Treasury securities, they essentially provide a loan to the government that it is obligated to pay back. These ‘loans’ range in maturity from a month all the way out to 30 years. Recent treasury rates and corresponding maturities look something like this:

Based on TVM, the 10-year treasury rate should not be less than the 1-year rate, but it is. How can this be? The answer is because both the Federal Reserve and market participants who invest in treasuries have made it so. The Federal Reserve influences the shorter part of the curve by increasing (or lowering) short-term interest rates. As I’m sure most folks have noticed, there’s been quite a few rate increases of late, with the anticipation of more to come. The broader investing community has much more influence over the long end of the yield curve. If these market players become worried about potentially negative economic conditions (ex. a recession), they will invest heavily in the longer end, betting that the Federal Reserve will be forced to lower interest rates to re-stimulate the economy. So, the Federal Reserve increasing short-term interest rates to fight inflation, coupled with the market pushing down long-term rates in anticipation of a recession, has all but eliminated TVM in the current economic environment.

There’s no punchline here. The purpose of this message was to work through what is a widely embraced financial concept and point out that we’re currently living in a time where it’s broken down. I wish I had a better crystal ball to predict what will happen next, but I’ll borrow a quote from economist J.K. Galbraith in that regard, “There are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know”. Quoting dead economists? For the sake of the handful of folks who stayed awake long enough to get to the end of this, I’ll wrap it up.

Final Thought: You know things have gotten weird when your acupuncturist has an opinion about Federal Reserve interest rate policy.

Final Final Thought: Does acupuncture actually work? Heck if I know. Ask me in a few months.

Good luck and happy hunting,

Tom Moran

CEO & President

July 2022

As I write this, the talking heads on a business news channel are informing viewers that the rate of inflation in the United States jumped up to over 9% during the month of June. This marks the highest pace for inflation going all the way back to November of 1981. Simply defined, inflation is a broad increase in the price of goods and services in an economy, accompanied with a fall in the purchasing value of money. It's hard to ignore, because it's everywhere you turn: fuel, diapers, furniture, microchips, even hot dogs. The eye-watering prices at the pump are probably most evident, but I want to dig a little deeper into the pricing behavior on that last item - hotdogs. It's a topic that's a bit more on our minds around here at Community Bank, because after a 2-year hiatus we're dusting off the grills and getting the Customer Appreciation Barbeques at our branches back on track (click here for BBQ dates).

About hotdogs and inflation. It’s hard to believe, but I’ve worked for Community Bank for a little over 20 years now. This got me thinking - what was the cost of a hotdog when I started at the Bank in 2001 compared to 2022? Luckily there's this little contraption called the Internet where the answer to this most critical question resides. According to Mr. Google, the average price for hotdogs in 2001 was $2.27 per lb. Fast forward to 2022, and it’s now $5.22 per lb. That's an increase of 130%! To throw a few more numbers at it, competitive eater (yes, that’s a job) Joey Chestnut recently won the 2022 Nathan’s Hot Dog Eating Contest by eating 63 hot dogs in 10 minutes. At 10 hot dogs per pound, that works out to a cost of $32.88 in 2022, versus $14.30 in 2001. Imagine if he showed up and did this at all 10 of our Customer Appreciation BBQ's. Consequently, he won't be getting an invite.

Many folks have little experience in facing the challenges created by elevated levels of inflation. Afterall, the country hasn’t experienced this in 40 years. While it impacts everyone differently, here are some general recommendations that will hopefully help take the edge off.

First, put together a budget. For several of our customers, this can be a difficult exercise, and an even harder one to stick to once it’s completed. Nevertheless, in an economic environment where costs are skyrocketing, a budget can be crucial in identifying where expenses are increasing, and to support spending decisions. If you need help getting started, check out our new My Financial Toolkit service that we offer through our online banking platform. Alternatively, just give us a call and we’d be happy to assist.

Second, try to pay-off your floating (variable) debt. What in the world? Isn’t Community Bank in the business of lending money? Of course we are, but we’re also in the business of helping our customers make smart financial decisions. If you haven’t noticed, interest rates have gone up. Fast. That means many debt instruments tied to a variable rate – credit cards, HELOC’s, lines of credit – are much more expensive now than they were even a recently as a few months ago. Again, everyone’s financial situation is different, but prioritizing the payment of your variable debt over your debt with fixed interest rates should get a hard look right now.

Lastly, maintain a good old-fashioned savings account. Honestly, this is a good idea even during non-inflationary times. I know, easier said than done in an environment where inflation leaves a painful mark. However, setting aside money now will help to cushion any future unexpected expenses or other painful financial situations.

This country will likely feel the effects of inflation for a good long while. With that said, following a few of these time-tested practices will help you navigate through it. Hope to see everyone (except Joey Chestnut) at our BBQ's this summer. The rainy weather appears to be over for now - get out there and enjoy some sunshine.

Tom Moran

CEO/President